Strong Financial Performance and Strategic Growth at Upper Amenfi Rural Bank

Upper Amenfi Rural Bank has demonstrated impressive financial growth in the 2024 financial year, reporting a profit before tax of GH¢25.65 million. This represents a significant 153.35 percent increase compared to the previous year. The bank attributes this remarkable performance to strong asset and deposit growth, along with effective cost management.

Expansion of Assets and Deposits

The bank’s total assets surged by 78.38 percent, reaching GH¢669.75 million from GH¢373.18 million in 2023. Customer deposits also saw a similar rise, growing by 78.39 percent to GH¢614.68 million from GH¢344.60 million. This growth positions Upper Amenfi Rural Bank as the fourth-largest rural bank in Ghana in terms of deposit mobilization, highlighting its increasing influence in the sector.

Robust Capital Position

In addition to these gains, the bank reported a capital adequacy ratio of 27.50 percent, which is well above the Bank of Ghana’s (BoG) regulatory minimum benchmark of 10 percent. This high capital ratio indicates a strong solvency position, allowing the bank to withstand potential economic shocks both internally and externally.

Leadership and Economic Context

At the bank’s 35th Annual General Meeting (AGM), Board Chairman Anthony Mensah highlighted that the results reflect disciplined financial oversight despite macroeconomic challenges. He emphasized that profitability was maintained through cost efficiency and sound governance. The bank’s performance occurred during a year marked by both opportunities and headwinds for Ghana’s economy, with the country recording a GDP growth of 5.7 percent in 2024, driven by agriculture, mining, and digital innovation.

However, persistent inflation, currency fluctuations, and fiscal consolidation measures continued to pose challenges for businesses and households. Despite these pressures, policy reforms supported by the International Monetary Fund (IMF) provided some relief to the financial sector.

Embracing Digital Transformation

Mr. Mensah noted that digital banking continued to evolve, with fintech partnerships and mobile money transactions increasing rapidly. He emphasized that rural and community banks remain essential in promoting financial inclusion, particularly for underserved populations.

Despite rising competition in the sector, the bank remains committed to delivering value to customers and shareholders.

Future Outlook and Strategic Initiatives

Headquartered in Ankwawso in the Amenfi Central District of the Western region, the bank plans to continue investing in digital infrastructure and inclusive financial services to sustain its growth momentum. Mr. Mensah stated that the board is committed to growing the bank to be among the top five Rural and Community Banks (RCBs) in the country.

Agency banking has become a cornerstone of the bank’s strategy to extend financial services to underserved and unbanked populations. By leveraging a network of trusted agents in small communities, the bank has brought banking closer to people, eliminating barriers related to distance, cost, and accessibility.

The bank aims to expand its reach to areas such as Wassa Dominase Nkwanta, Denkyira Nkotumso, Wassa Ankasie, Sefwi Debiso, Wassa Pewuako, and Wassa Gyedua Ketewa. At Upper Amenfi Rural Bank, the future of banking lies in seamless, secure, and accessible digital solutions that empower customers anytime, anywhere.

To achieve this, the bank has activated various digital platforms, including USSD, GhanaPay, Ezwich, AIP, and NRT, offering convenience for customers to perform financial transactions reliably.

Dividend Payout and Recognition

In recognition of the bank’s performance, the board proposed a dividend payout of GH¢0.10 per share. This recommendation, approved by BoG, was presented to shareholders for final approval. Mr. Mensah stated that this reflects the bank’s commitment to rewarding shareholders while reinvesting in innovation and expansion.

During the 2024 financial year, the bank was named First Runner-up in Deposit Mobilisation among rural banks in Ghana by the Association of Rural Banks. The board chair attributed this recognition to staff dedication and customer loyalty, expressing that such accolades motivate the team to aim higher.

Corporate Social Responsibility

Mr. Mensah reiterated the bank’s commitment to community development through its Corporate Social Responsibility (CSR) initiatives, investing a total of GH¢665,445 during the year. These efforts included supporting education through scholarships, funding health programs, and investing in local infrastructure, reflecting the bank’s mission to promote sustainable growth in the communities it serves.

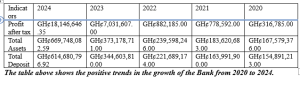

Key Financial Performance Indicators

Here are some key financial highlights from the 2024 financial year:

- Total Income: GH¢96,844,654 (up 75.34% from GH¢55,234,039 in 2023)

- Total Deposit: GH¢614,680,797 (up 78.38% from GH¢344,603,811 in 2023)

- Total Investment: GH¢535,000,000 (up 129.08% from GH¢233,547,954 in 2023)

- Loans and Advances: GH¢76,935,715 (up 9.99% from GH¢69,952,544 in 2023)

- Shareholders’ Funds: GH¢31,095,424 (up 143.91% from GH¢12,749,027 in 2023)

- Paid-up Capital: GH¢3,868,451 (up 5.45% from GH¢3,668,700 in 2023)

- Profit Before Tax: GH¢25,649,892 (up 153.35% from GH¢10,124,197 in 2023)

- Total Assets: GH¢669,748,083 (up 79.48% from GH¢373,178,710 in 2023)

- Capital Adequacy Ratio: 27.50% (up 158.46% from 10.64% in 2023)