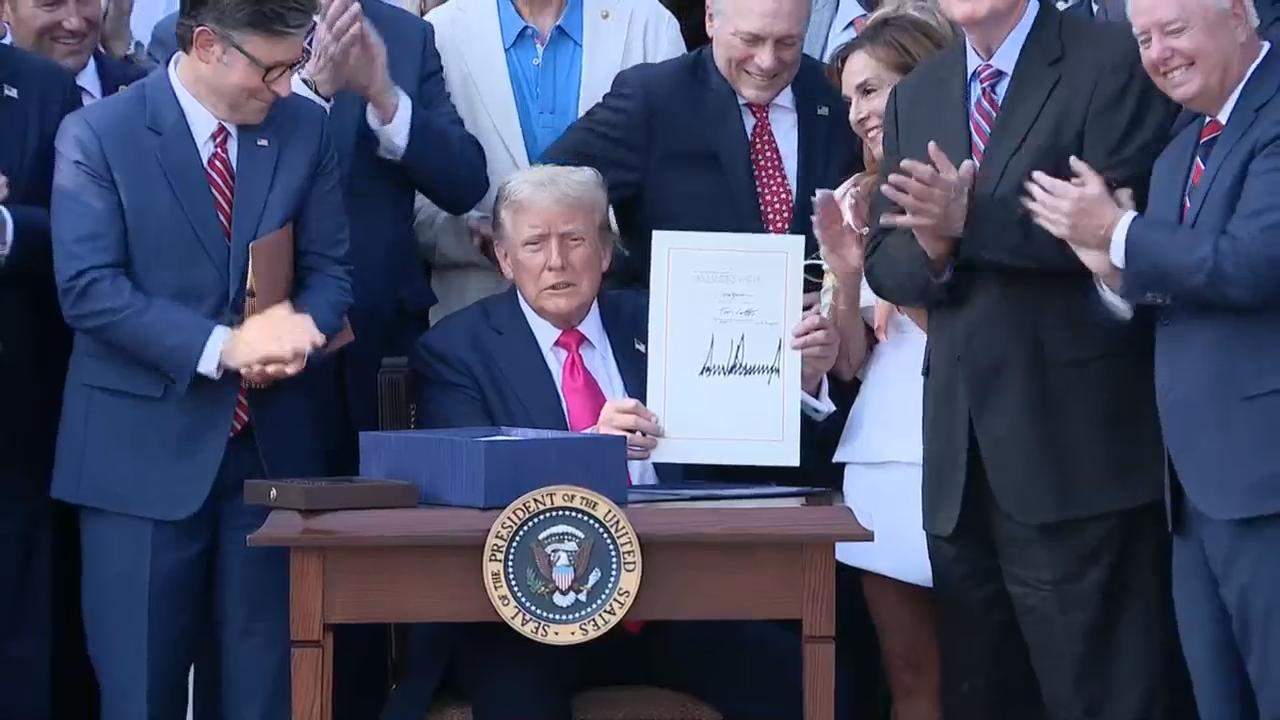

The passage of the sweeping “One Big Beautiful Bill Act” by President Donald Trump has sparked a wave of speculation and analysis, particularly in states like North Carolina, where its economic and political implications are being closely examined. The legislation, officially designated as HR1, represents a major overhaul of federal spending and tax policy, with wide-ranging consequences for both national and state-level governance.

Economists and policymakers in North Carolina caution that it is still too early to determine how the complex provisions of the bill will impact the state’s economy. However, discussions have centered on two key elements: potential business and individual tax cuts and significant reductions in federal spending on programs such as food assistance, Medicaid, and education.

Mike Walden, an economist at NC State University, highlighted that much of the media attention surrounding the bill has focused on the spending cuts, while less emphasis has been placed on the potential benefits of reduced taxation. According to Walden, the administration’s strategy hinges on these tax cuts spurring enough economic growth to offset the reductions in federal outlays.

“If they can get economic growth going up a percentage point, even two percentage points, that can be amazing in terms of business development, in terms of jobs,” Walden explained. He added that if the administration’s projections materialize, North Carolina could see a noticeable boost in economic activity.

However, Walden also pointed out a major concern: the uncertainty surrounding tariffs set to take effect on July 9 unless postponed. “I’ve talked [to] a lot of business groups. That’s the number one issue they talk about,” he said. “If the tariffs are imposed, that could wipe out any, in my opinion, any benefits in terms of economic growth from the bill that was just passed.”

Beyond economics, political scientists are watching how the new law might influence the upcoming midterm elections. Chris Cooper, a political scientist at Western Carolina University, noted that the bill’s complexity makes it difficult to predict its partisan impact.

“There are going to be parts of your life that probably are better from this bill, parts of your life that are worse for this bill,” Cooper said, emphasizing that outcomes will vary depending on income level, geographic location, and personal circumstances.

He warned that the federal spending cuts place state lawmakers in a difficult position, especially regarding decisions on whether to implement additional state-level tax cuts or increase funding to compensate for reduced federal support.

Republican legislative leaders now face tough choices about how to manage state finances in light of the federal rollbacks, particularly concerning essential services like food assistance and Medicaid. Cooper described the situation as a “rock and a hard place” dilemma, noting that the long-term effects of the deepest cuts won’t be felt until after the 2026 midterms—potentially giving Republicans time to benefit from any short-term economic gains.

Still, not all Republicans are convinced of the bill’s benefits. Senator Thom Tillis voiced concerns that the legislation could harm both the economy and the party’s electoral prospects, echoing broader skepticism within the political sphere.

As North Carolina navigates the early stages of this legislative shift, stakeholders remain divided on whether the promised economic windfall will outweigh the costs of reduced federal support.