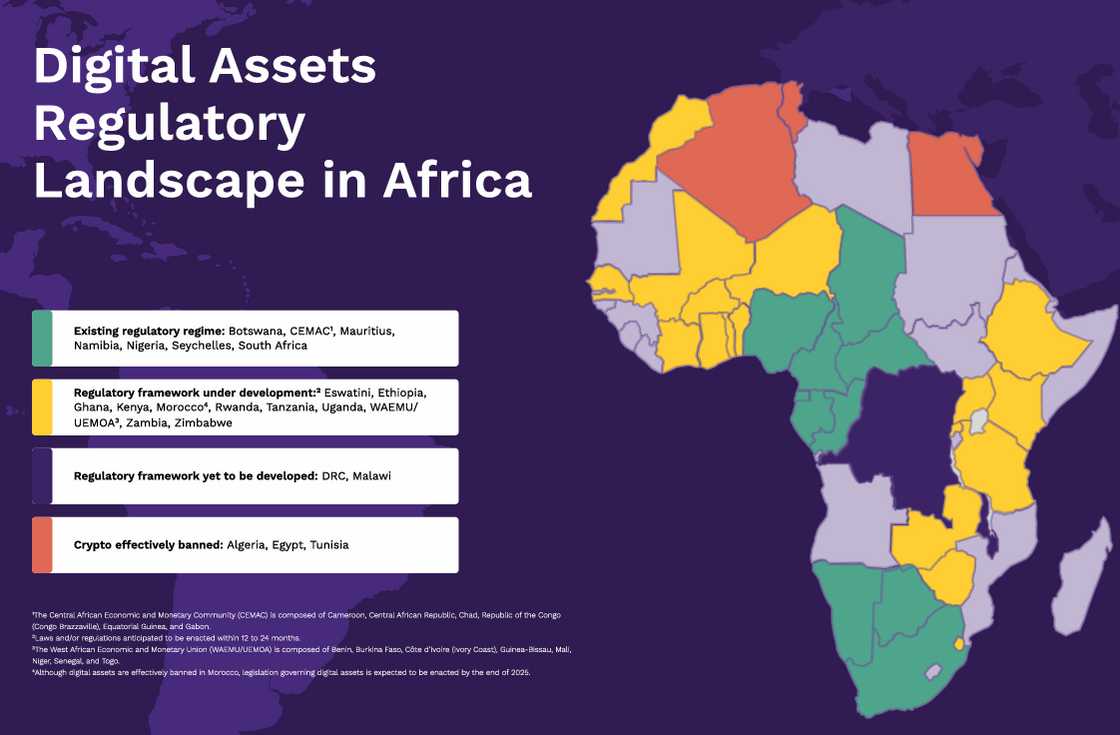

Yellow Card released a report on the state of digital asset regulations in Africa in 2025.

According to the report, there are over 54 million users of digital assets or cryptocurrencies in Africa.

Tolong support kita ya,

Cukup klik ini aja: https://indonesiacrowd.com/support-bonus/

Africans have continued to gain momentum when it comes to the adoption of blockchain technologies and digital assets, particularly the use of stablecoins for cross-border transactions.

The stablecoins have also made it easier to gain access to US dollars in the form of USD stablecoins.

Top users of digital assets in Africa

Nigeria is not only leading Africa in the adoption of stablecoins, but it is also the second biggest adopter in the world, with an estimated 25.9 million digital asset users.

Ten African countries are among the top 50 adopters in the world.

1. Nigeria – Ranked 2nd in the world

2. Ethiopia – Ranked 26th in the world

3. Morocco – Ranked 27th in the world

4. Kenya – Ranked 28th in the world

5. South Africa – Ranked 30th in the world

6. Uganda – Ranked 34th in the world

7. Algeria – Ranked 43rd in the world

8. Egypt – Ranked 44th in the world

9. Ghana – Ranked 46th in the world

10. Democratic Republic of the Congo – Ranked 48th in the world

Regulation of virtual asset service providers (VASPs)

The growing popularity of stablecoins and digital assets among individuals, businesses, and some financial institutions has prompted increased regulatory attention in Africa.

In response, many African regulators are developing legal frameworks to protect consumers, enhance transparency, combat financial crimes, and encourage fintech innovation.

Regulatory approaches across the continent vary, ranging from maintaining existing policies and reversing bans to introducing sandboxes, drafting legislation, and enacting comprehensive laws for digital assets and virtual asset service providers (VASPs).

The main area of concern in the regulation of the use of digital assets is the risks of money laundering and terrorism financing.

African governments have adopted varying approaches to applying anti-money laundering and counter-terrorism financing (AML/CFT) laws to digital assets and virtual asset service providers (VASPs).

In Kenya, the VASPs bill is currently being processed in parliament, and it sets out a legal framework for the licensing of the VASPs and use of digital assets in the country.

Speaking to .co.ke, Edline Murungi, senior legal counsel at Yellow Card, said the company has already set up high compliance standards to ensure their platform is not used for criminal activities.

“At Yellow Card, we maintain the highest standards of compliance with Kenya’s Anti-Money Laundering and Counter-Terrorism Financing laws, as well as international regulatory frameworks. We have implemented robust cybersecurity protocols and comprehensive risk management programs to protect our platform and users,” Murungi said.

Some countries have amended AML/CFT laws to include digital assets and require VASPs to register or report to financial intelligence units, while others allow voluntary reporting despite lacking specific legal frameworks or licensing requirements.