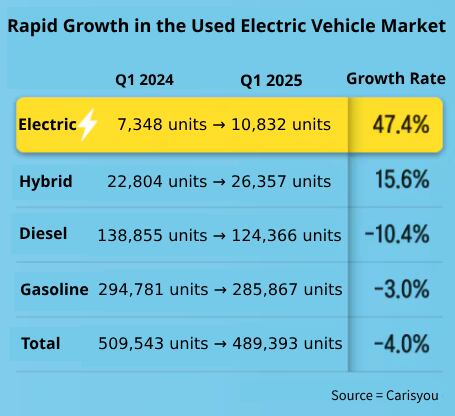

South Korea’s used car market saw sales of approximately 490,000 vehicles in the first quarter of this year (January to March), marking a 4 percent decline from the same period last year. Amid persistent inflation and high interest rates, consumers are pulling back on major purchases—including both new and secondhand vehicles. Yet, one segment is bucking the trend: electric vehicles. Used electric vehicle (EV) sales surged nearly 50 percent year-over-year in the first quarter, a stark contrast to the overall market slowdown. For the first time on a quarterly basis, sales of pre-owned EVs exceeded 10,000 units, representing the fastest growth across all fuel types, including hybrids, gasoline, and diesel. Although EVs in the new car market continue to face challenges from steep price points and inadequate charging infrastructure, they are commanding premium prices and gaining popularity in the resale market.

Industry experts attribute this strong performance to the distinctive features of EVs, which are reshaping consumer expectations in the pre-owned auto sector. Historically, South Korea’s used car market has been regarded as a “lemon market,” fraught with high-risk, low-quality vehicles. But EVs—containing 30 to 40 percent fewer parts than internal combustion engine (ICE) models—tend to be more durable and require less frequent maintenance, helping to alleviate some of the traditional concerns associated with secondhand cars. The rising value of EV batteries, which account for roughly 40 percent of a vehicle’s total price, is another factor driving interest. As battery recycling technology advances, concerns over rapid depreciation are diminishing, and consumer confidence in long-term value retention is growing.

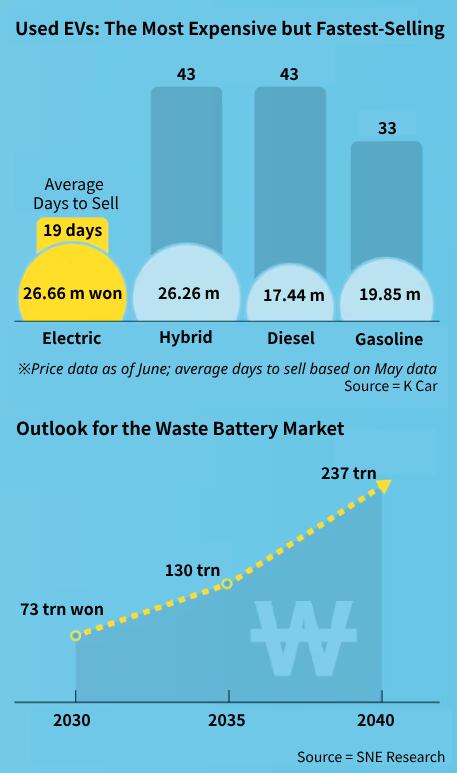

According to Carisyou, used EV sales in the first quarter reached 10,832 units—up 47.4 percent from the same period in 2023. In comparison, hybrid vehicle sales rose by 15.6 percent, but this was down from a 36.2 percent increase in the previous year. Sales of gasoline, diesel, and liquefied petroleum gas (LPG) vehicles all declined—by 3 percent, 10.4 percent, and 8.6 percent, respectively. EVs are not only gaining in volume but also selling more quickly. Data from the used car platform K Car shows the average listing price for used EVs in May stood at 26.66 million won, higher than hybrids at 26.26 million won and gasoline vehicles at 19.85 million won. In terms of turnaround, used EVs took an average of just 19 days to sell in May, significantly faster than gasoline vehicles at 33 days and hybrids at 43 days.

Industry sources point to a shifting perception of EVs in the used car space. As vehicles age, their maintenance demands increase. However, electric cars—with simpler internal structures and fewer components—are less prone to breakdowns, making them attractive to buyers seeking to minimize repair costs. Data from the German automotive association ADAC shows EVs average 4.2 breakdowns per 1,000 vehicles, less than half the rate for ICE vehicles, which average 10.4 breakdowns per 1,000.

“Used car buyers are particularly sensitive to repair costs that arise from aging or mechanical failure,” one industry insider said. “EVs already offer low fuel and maintenance costs, and their reliability is increasingly becoming a major selling point.”

The profile of top-selling used EVs is also becoming more diverse. While premium foreign brands once dominated the space, demand is now shifting toward more practical options like compact SUVs and mini cars. In the first quarter, the three most popular used EV models were the compact SUVs Ioniq 5 and EV6, followed by the mid-size sedan Model 3. Tesla’s Model 3, which held the top spot two years ago, fell to third place this year.

Previously, buyers were largely motivated by the opportunity to purchase luxury imports like Tesla at a discount. Today, practicality is driving demand, with more small business owners and households seeking second vehicles for everyday use. According to K Car, the used EVs with the fastest appreciation in value include the subcompact SUV Kona Electric and the compact recreational vehicle Ray EV—both prized for their compact size and spacious interiors.