An auto parts manufacturer based in Ansan, Gyeonggi-do, has been thrust into crisis following the imposition of new tariffs by the United States. Company A, which supplies components to a U.S.-based vehicle assembly plant operated by a client, has been subject to tariffs of up to 25% since May 4.

The impacted shipments account for 15 to 20 percent of the company’s total revenue. Under the current tariff structure, a part sold for 100 won incurs a 25-won tariff. With the company’s operating profit margin below 4%, its U.S. export business is now operating at a loss—resulting in a 20-won deficit per 100-won transaction.

South Korean auto parts manufacturers are facing a pivotal challenge as the so-called “Trump tariffs” take effect. Of the approximately 13,000 auto parts companies in South Korea, an estimated 7 to 8 percent export to international markets, including the U.S.

Many of these firms had made bold inroads into the world’s largest automotive market, with some entering as early as 25 years ago, while others made their debut as recently as last year. Today, the United States stands as a core market for South Korea’s auto parts sector.

However, since the 25% tariff went into effect on May 4, the financial viability of shipping to the U.S. has sharply deteriorated.

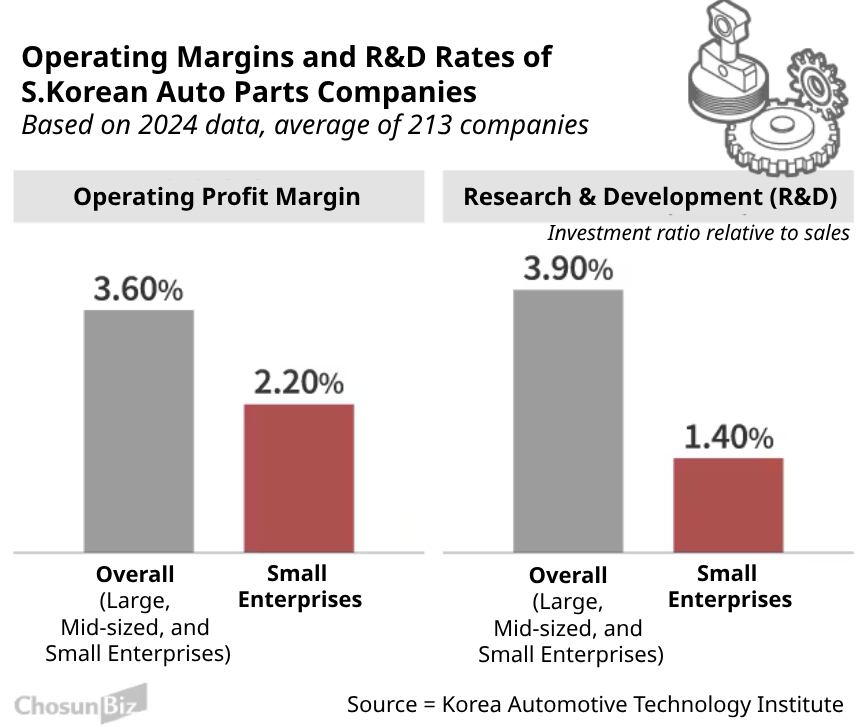

Last year, the average operating profit margin for South Korean auto parts exporters was estimated to be in the 3% range. Industry experts warn that if the elevated tariffs persist, margin compression could escalate into a broader liquidity crisis across the sector.

According to a recent report by the Korea Automotive Technology Institute, the average operating profit margin for 213 South Korean auto parts manufacturers in 2024 stood at approximately 3%. The list includes large and mid-sized firms such as Hyundai Mobis, SL Corporation, and Sambo Motors, as well as small and medium-sized enterprises like Kwangjin.

Sambo Motors, a mid-tier supplier that exports powertrain components including plates and fuel pipes to the U.S., reported an operating profit margin of 3.4% last year. DY Auto, which produces wiper systems, recorded a margin of just 1%, while Hyorim E&I—a small manufacturer of drivetrain parts such as brake discs and propeller shafts—posted a 2.3% margin.

With average margins already thin, companies like Company A are now at risk of falling into negative profitability if forced to continue paying the 25% tariff. Although the scale of U.S. exports and local production varies by firm, analysts broadly agree that the tariffs will deliver a blow to South Korea’s entire auto parts industry.

The erosion of profitability is also seen as a threat to the sector’s ability to invest in future-oriented technologies, including autonomous driving systems.

Sunwoo Myung-ho, a distinguished professor in the Department of Automotive Engineering at Korea University, cautioned against underestimating the impact of declining profitability in such a key market. “This could directly result in reduced R&D investment,” Sunwoo said, “potentially sidelining South Korean parts suppliers in the future autonomous vehicle industry.”

An executive at one parts supplier said, “We’re holding up for now, but if these tariffs drag on, the situation could become untenable. Smaller firms will likely feel the strain first.”

An official at a South Korean firm that has operated a U.S. factory for over two decades noted, “Our local operations have been stable, but now that tariffs are being imposed, we’re watching the situation closely—it’s too uncertain to predict what comes next.”

Auto parts manufacturers remain heavily reliant on their clients—the finished vehicle producers. Although automakers may raise vehicle prices to absorb the increased tariff burden, suppliers argue that any gains must also be shared across the supply chain. Most South Korean parts companies supply Hyundai Motor and Kia, both at home and in the U.S. market.

“As production costs rise due to tariffs, there needs to be a mechanism that allows for corresponding increases in parts pricing under contracts with automakers,” said one industry official.