Samsung Electronics, the world’s leading TV maker for nearly two decades, is seeing its grip on the premium market weaken. In the Mini LED TV segment, a high-end category of LCD TVs that Samsung has heavily focused on, the company has fallen to fourth place in global sales, overtaken by fast-rising Chinese competitors.

Chinese brands are rapidly closing the technological gap while offering larger screens at lower prices, challenging Samsung’s long-held edge in quality. As picture quality differences narrow, consumers who once favored premium brands like Samsung and LG are opting for larger, more affordable alternatives, gradually shifting leadership in the premium TV market to Chinese manufacturers.

According to market tracker Counterpoint Research, Samsung ranked fourth in Mini LED TV sales by units and third in revenue in the first quarter of this year. The company, which led the segment through 2023, was overtaken in quick succession by Chinese players TCL, Hisense, and Xiaomi. Mini LED TVs use thousands of smaller LED backlights compared to standard LCD TVs, delivering enhanced brightness and contrast.

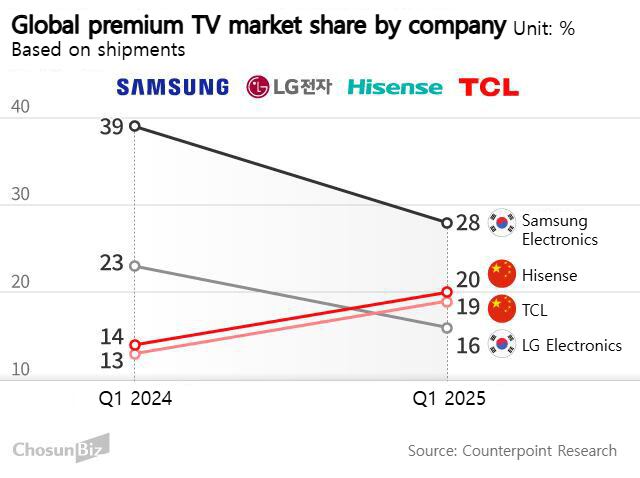

Samsung’s decline is also evident across the broader premium TV market. Its global market share by sales volume fell from 39% a year earlier to 28% in the first quarter. LG Electronics saw a similar decline from 23% to 16%. Meanwhile, Hisense increased its share from 14% to 20%, and TCL from 13% to 19%.

This drop in market share across all premium segments suggests that Samsung’s advantage in both price and quality is under pressure. Industry observers say the old perception that Chinese TVs are low quality has largely faded. “It’s now widely accepted that Chinese brands have caught up technologically,” said one electronics industry insider. “Consumers are comparing the screens in person and finding that the picture quality is more than good enough. There’s no longer a strong reason to insist on Samsung.”

Chinese brands have risen quickly by combining improved technology with a value-focused strategy. They now dominate the large LCD panel market, which is essential for Mini LED TVs, giving them an advantage in both price and supply. TCL has achieved vertical integration through its panel-making unit CSOT, while Hisense has built a stable production system based on its domestic supply chain.

In response, Samsung is shifting focus to OLED TVs, a segment Chinese firms have largely stayed away from due to low profitability. After reentering the OLED market three years ago, Samsung has been expanding its lineup with the goal of becoming the top player. Analysts view the move as Samsung’s attempt to regain profitability and set itself apart technologically, after losing pricing power in the LCD sector.

However, the market is moving in a different direction. Mini LED TV shipments and revenue overtook OLEDs in the second quarter of last year and continue to expand in the ultra-premium segment. Bob O’Brien, research director at Counterpoint, noted that consumers are facing a choice between a smaller OLED TV and a larger Mini LED TV at similar price points. “An increasing number of consumers are choosing Mini LEDs,” he said.

To break out of this dilemma, Samsung is now emphasizing artificial intelligence (AI)-powered TVs. Rather than focusing solely on panel type or size, the company is promoting its proprietary AI processors that enhance picture and sound quality. Still, this is not an exclusive strategy. Chinese competitors like TCL and Hisense have already released models with their own AI chips, narrowing the gap further.

“Just as Samsung once dethroned Sony’s CRT supremacy with large-screen LCDs, China is now using giant Mini LEDs to challenge Samsung,” the industry source said. “High picture quality is expected, but consumers now also demand larger screens and affordable prices. Samsung needs to adapt quickly or risk losing the dominance it has held for 20 years.”