Major Impacts of the New Bill on Seniors and Other Groups

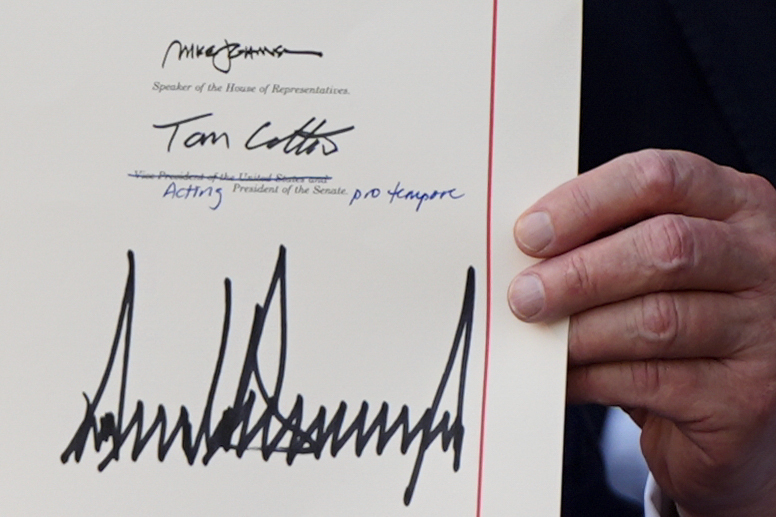

The recently signed “megabill” by President Donald Trump contains a wide range of provisions that will affect various groups across the United States. Among those impacted are parents, guardians, individuals with student loans, and over 200 people recognized as American heroes. However, one group that is expected to see significant changes is seniors.

Tax Deduction for Seniors

One of the most notable benefits for seniors aged 65 or older is the $6,000 tax deduction, which is set to last through 2028. This deduction applies to seniors earning up to $75,000 individually or $150,000 for those filing jointly. The amount of the deduction decreases with higher income, eventually phasing out for individuals earning more than $175,000 or couples earning more than $250,000.

According to estimates from the Council of Economic Advisers, this deduction could eliminate the Social Security tax burden for 88% of seniors. Currently, 64% of seniors are already exempt from these taxes.

Changes in Food Assistance Programs

The bill also introduces changes to food assistance programs. Adults are now required to work until age 64 to qualify for the Supplemental Nutrition Assistance Program (SNAP). The only exception is for parents with children under the age of 14.

Medicaid Cuts and Work Requirements

Another significant aspect of the bill is the historic cuts to Medicaid. It also introduces new work requirements for the program, which apply to adults under the age of 65. These requirements are the first of their kind and aim to encourage participation in the workforce.

Additionally, individuals with an income above the poverty line—$15,650 for a single person and $21,150 for a two-person household—are required to cover co-pays for services such as lab tests and doctor visits. States can charge up to 5% of a person’s annual income for these expenses.

Impact on Healthcare Coverage

The bill also has implications for healthcare coverage. According to the Congressional Budget Office, if the bill becomes law, it is estimated that 11.8 million more Americans could become uninsured by 2034. Additionally, 3 million more people may no longer qualify for SNAP benefits.

Funding changes to Medicaid are scheduled to take effect in 2028, while the work requirements are expected to be implemented before the end of 2026.

Broader Implications

The bill’s impact extends beyond seniors and healthcare. It includes provisions that affect a variety of other areas, including education, social services, and economic policies. These changes are expected to have long-term effects on the financial stability and well-being of many Americans.

As the bill moves forward, its implementation will be closely watched by policymakers, advocacy groups, and the public. The goal is to ensure that the provisions align with the needs of the population while promoting economic growth and stability.