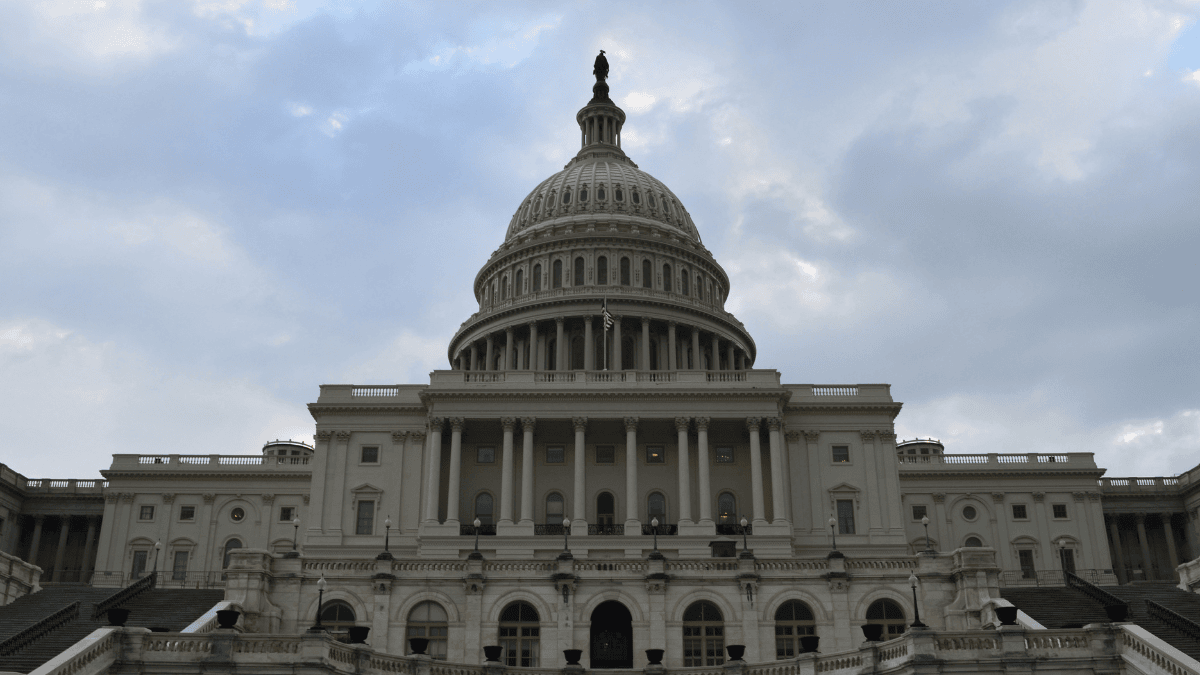

The U.S. House of Representatives recently passed a massive legislative package known as the

‘One, Big, Beautiful Bill’

, which aims to address the expirations of the

2017 Tax Cuts and Jobs Act

(TCJA) and introduce additional fiscal policy changes. The bill narrowly passed with a vote of 215 to 214, highlighting the contentious nature of its provisions. While the bill seeks to prevent tax increases for 62% of taxpayers, it also proposes significant tax cuts and changes to social safety net programs.

Concerns about the bill’s impact on the national debt are at the forefront of the debate. According to a preliminary analysis by the

Tax Foundation

, the bill’s tax provisions alone could reduce federal tax revenues by $4.1 trillion between 2025 and 2034. When considering economic growth, the reduction is estimated at $3.2 trillion. Overall, the bill could increase the budget deficit by $2.6 trillion over ten years conventionally, or $1.7 trillion dynamically.

The

Congressional Budget Office (CBO)

estimated that the bill would add $2.3 trillion to the federal deficit over a decade, while other estimates range from $2 trillion to $3 trillion. The

Committee for a Responsible Federal Budget

projected an addition of $3.3 trillion to the national debt, a figure echoed by the

Penn Wharton Budget Model

. Extending the TCJA tax cuts alone could cost $2.2 trillion, with additional tax breaks further increasing costs.

Despite being a Republican initiative, the bill faces significant resistance within the party. Senators like

Ron Johnson

and

Rand Paul

have voiced concerns about the likely increase in the deficit, arguing that the bill lacks sufficient spending cuts to offset tax reductions. Johnson suggests returning spending to pre-pandemic levels, while Paul criticizes the bill’s spending cuts as inadequate. The

House Freedom Caucus

also criticizes the bill for failing to significantly alter federal spending trajectories.

Investor Concerns

Financial markets have reacted skeptically to Trump’s promise of reducing deficits.

Moody’s Ratings

downgraded the nation’s debt, citing the potential for the bill to add trillions to the deficit. Investors demand higher premiums for government borrowing as total debt surpasses $36.1 trillion. An analyst from

Deutsche Bank

warns that the bill’s Section 899 could transform a trade war into a capital war, potentially devaluing U.S. dollar assets for foreign investors.

Many economists doubt that economic growth alone can offset the rising debt. Experts from the

American Enterprise Institute

and the

Center on Budget and Policy Priorities

express concerns about the bill’s impact. Michael Strain of AEI notes the lack of materialized spending cuts, while Brendan Duke of the Center on Budget and Policy Priorities argues the bill exacerbates future policy challenges. Kent Smetters of the Penn Wharton Budget Model criticizes the growth projections as unrealistic.

Even tech billionaire

Elon Musk

, who led the Department of Efficiency Government under Trump, expressed disappointment with the bill. Musk argues that it increases the budget deficit rather than reducing it, undermining his team’s efforts. His criticism adds to the growing skepticism surrounding the bill’s fiscal impact and its ability to achieve the intended debt reduction.

The

Trump administration

and House Republicans reject projections of increased deficits. White House Press Secretary

Karoline Leavitt

dismisses claims of deficit increases as erroneous, criticizing the CBO and other analysts for flawed assumptions. The administration argues that the bill will not increase the deficit, citing $1.6 trillion in savings and projecting rapid economic growth to reduce annual deficits relative to the economy.

House Speaker

Mike Johnson

defends the bill as a significant investment and economic catalyst, dismissing debt increase concerns as exaggerated. He claims the bill represents the largest spending cut in at least 30 years, emphasizing its potential to fuel the U.S. economy.