Strong Performance and Strategic Growth in Edwards Lifesciences

Edwards Lifesciences (EW) has been experiencing a positive trajectory driven by the widespread adoption of its premium surgical technologies. The company’s Transcatheter Aortic Valve Replacement (TAVR) platform is well-positioned to maintain its global leadership and achieve sustained growth. In the field of Transcatheter Mitral and Tricuspid Therapies (TMTT), Edwards benefits from a diverse portfolio of cutting-edge technologies that offer both repair and replacement solutions for patients with mitral and tricuspid valve issues. However, macroeconomic challenges and currency fluctuations have introduced some concerns for the company’s operations.

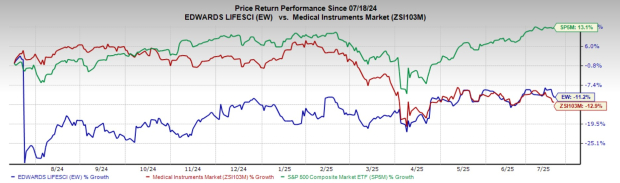

Over the past year, this Zacks Rank #2 (Buy) stock has seen a decline of 11.2%, which is less severe than the industry’s 12.9% drop and the S&P 500 composite’s 13.1% increase. With a market capitalization of $44.66 billion, Edwards’ earnings yield of 3.2% is favorable compared to the industry’s -3.6%. In the last four quarters, the company exceeded earnings estimates twice and matched them on two other occasions, with an average surprise of 3.5%.

Upsides for EW Stock

Surgical Structural Heart: A Promising Business

The Surgical Structural Heart segment, led by innovative RESILIA tissue, has shown strong performance. In the first quarter of 2025, the segment grew by 1% compared to the previous year, driven by the global adoption of premium surgical technologies such as INSPIRIS, MITRIS, and KONECT. The company continues to see positive procedure growth globally, especially for complex procedures. Edwards has also been expanding its RESILIA portfolio through continuous innovation.

In China, the launch of MITRIS received positive feedback from surgeons. Additionally, the acquisition of Endotronix in 2024 marked Edwards’ entry into implantable heart failure management (IHFM). This strategic move is expected to enhance the company’s offerings and expand its market reach.

TAVR Stands Strong

In the first quarter of 2025, TAVR sales surpassed $1 billion for the second consecutive quarter. The SAPIEN 3 Ultra RESILIA product performed solidly in the U.S., while its launch in Europe supported sales growth outside the country. Management expects continued momentum as more centers adopt these therapies. The next-generation SAPIEN X4 system is also in development.

In Japan, Edwards is focusing on expanding treatment options for atherosclerosis (AS), which is significantly undertreated among the elderly population. The CE Mark for the Alterra system for congenital heart patients has enabled the company to roll out this therapy in Europe, with positive feedback from clinicians. The company anticipates FDA approval of the JenaValve Trilogy Heart Valve System in late 2025, which will be the first approved therapy for patients suffering from aortic regurgitation (AR).

TMTT Portfolio Holds Potential

The TMTT segment saw a 58% increase in sales compared to the prior year, driven by the PASCAL system and the continued introduction of the EVOQUE system in the U.S., Europe, and globally. The growing adoption of PASCAL highlights its premium differentiation and value to physicians and patients. The PASCAL technology is expanding in both new and existing sites worldwide.

Management is pleased with the earlier-than-expected completion of enrollment for the CLASP IITR trial, which studies TR patients using PASCAL against optimal medical therapy. The EVOQUE commercial rollout is progressing well, with new sites activated in the U.S. and Europe. In April, the SAPIEN M3 mitral valve replacement system received CE Mark for the transcatheter treatment of patients with symptomatic mitral regurgitation who are unsuitable for surgery or edge-to-edge therapy.

Concerns for Edwards

Macro Concerns Put Pressure on the Bottom Line

Global economic volatility, including inflation, credit, and capital market conditions, along with geopolitical factors, is impacting the industry. Inflationary pressures, supply constraints, and regulatory changes are affecting operating results. Edwards anticipates pressure on its operating margin throughout 2025 due to reciprocal tariff rates.

Foreign Exchange Headwinds

Foreign exchange is a significant headwind for Edwards due to the substantial portion of revenues generated outside the U.S. Unfavorable foreign currency impacts have affected gross margins over the past few quarters. In the first quarter, foreign exchange rates reduced reported sales growth by 170 basis points year over year.

EW Stock Estimate Trend

The Zacks Consensus Estimate for Edwards’ 2025 earnings per share (EPS) remains at $2.46 over the past 60 days. For 2025 revenues, the estimate is set at $5.91 billion, reflecting a 1.1% decrease from the previous year.

Other Key MedTech Picks

Other top-ranked stocks in the broader medical space include:

- Phibro Animal Health (PAHC): Estimated long-term earnings growth rate of 26% compared to the industry’s 13.9%. Shares have risen 60.5% over the past year.

- Cardinal Health (CAH): Carries a Zacks Rank #2 with an estimated long-term earnings growth rate of 10.9%. Shares have surged 67.7%.

- Cencora (COR): Carries a Zacks Rank #2 with an earnings yield of 5.3%. Shares have risen 30.8% over the past year.