AbbVie ABBV is a leading player in the field of neuroscience, which includes popular drugs like Botox Therapeutic and the antidepressant Vraylar. In recent years, the company has broadened its offerings in this area to now feature oral migraine treatments Qulipta and Ubrelvy, as well as the latest addition, Vyalev, used for Parkinson’s disease. Revenue from the neuroscience division made up more than 17% of AbbVie’s first-quarter income, reflecting a 16% increase compared to the previous year.

Our model predicts that the total neuroscience division will generate $2.5 billion in sales for the second quarter of 2025, reflecting approximately a 15% increase compared to the previous year. Increased sales of Botox Therapeutic and Vraylar are expected to have driven this growth during the period. Sales of Ubrelvy and Qulipta may have seen an uplift due to gains in market share within their approved uses.

Although Vyalev was recently introduced in the United States and is anticipated to generate limited local revenue during the second quarter, the medication has already received approval in multiple global markets. Therefore, it is probable that most of Vyalev’s sales in the second quarter originated from outside the U.S.

Although AbbVie’s neuroscience division is expanding significantly, investor attention will primarily center on its immunology business, which includes three key medications — Humira, Rinvoq, and Skyrizi. The market will be closely watching the extent of their sequential growth and gains in market share when the company releases its second-quarter results on July 31.

Rivalry within the Field of Neuroscience

Other larger competitors in this area are Biogen BIIB and Johnson & Johnson JNJ.

Although revenues from its multiple sclerosis business have significantly decreased, Biogen still earns over half of its total income from neuroscience treatments. BIIB is among a small number of companies that offer an FDA-approved therapy for Alzheimer’s disease (AD), Leqembi, in collaboration with Eisai. Biogen also sells Zurzuvae, the first and only FDA-approved oral medication for postpartum depression (PPD).

Although AbbVie is not directly competing with Biogen in the neuroscience field, it is actively working on Alzheimer’s disease treatments as part of its broader strategy to expand within neuroscience.

J&J offers a range of top-tier neuroscience products, with the highly successful antidepressant nasal spray Spravato and the antipsychotic medication Invega Sustenna leading the way. These continue to be significant contributors to the growth of the company’s pharmaceutical division. In April, J&J completed the purchase of Intra-Cellular Therapies, which brought the antidepressant drug Caplyta into its neuroscience lineup. Although Caplyta is already approved for treating schizophrenia and bipolar depression, a regulatory submission is currently being reviewed by the FDA for a third use — major depressive disorder — with a decision anticipated later this year.

ABBV’s Stock Performance, Valuation, and Projections

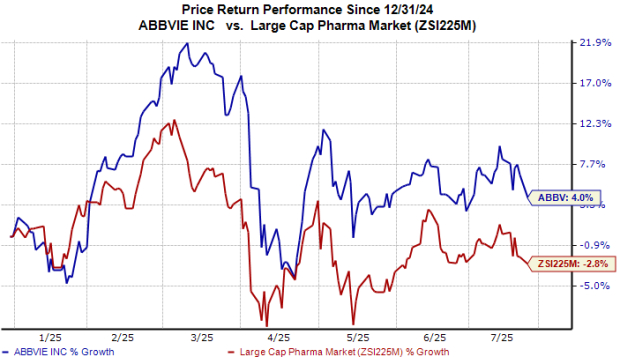

AbbVie’s stock has performed better than the industry so far this year, as illustrated in the chart below.

Image Credit: Zacks Investment Research

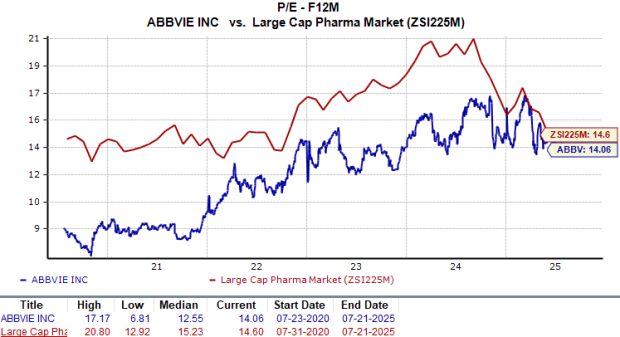

From a valuation perspective, AbbVie is not considered particularly inexpensive. Using the price-to-earnings (P/E) ratio, the company’s shares are currently trading at 14.06 times forward earnings, slightly below its industry average of 14.60. The stock is more affordable than certain other major pharmaceutical companies, like Eli Lilly and Novo Nordisk, but it is significantly more expensive than most other large drugmakers. The stock is currently trading above its five-year average of 12.55.

Image Credit: Zacks Investment Research

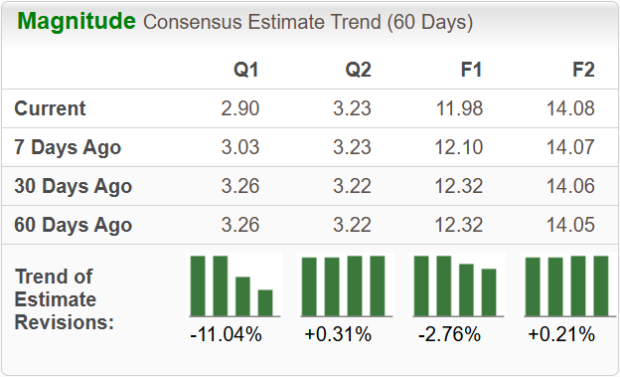

Although the EPS forecasts for 2025 have dropped from $12.32 to $11.98, the projections for 2026 have risen from $14.06 to $14.08 in the last 30 days.

Image Credit: Zacks Investment Research

AbbVie currently has a Zacks Rank of #3 (Hold). You can seethe full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This piece was first published on Zacks Investment Research ().