Manager of Link Reit expects more rent pressure at home, while Singapore and Australia assets perform well

Hong Kong-based Link Asset Management expects more tenants to negotiate lower rents in the near term as it prioritises keeping its properties occupied, according to top executives at the company that manages

Link Reit

, Asia’s largest real estate investment trust.

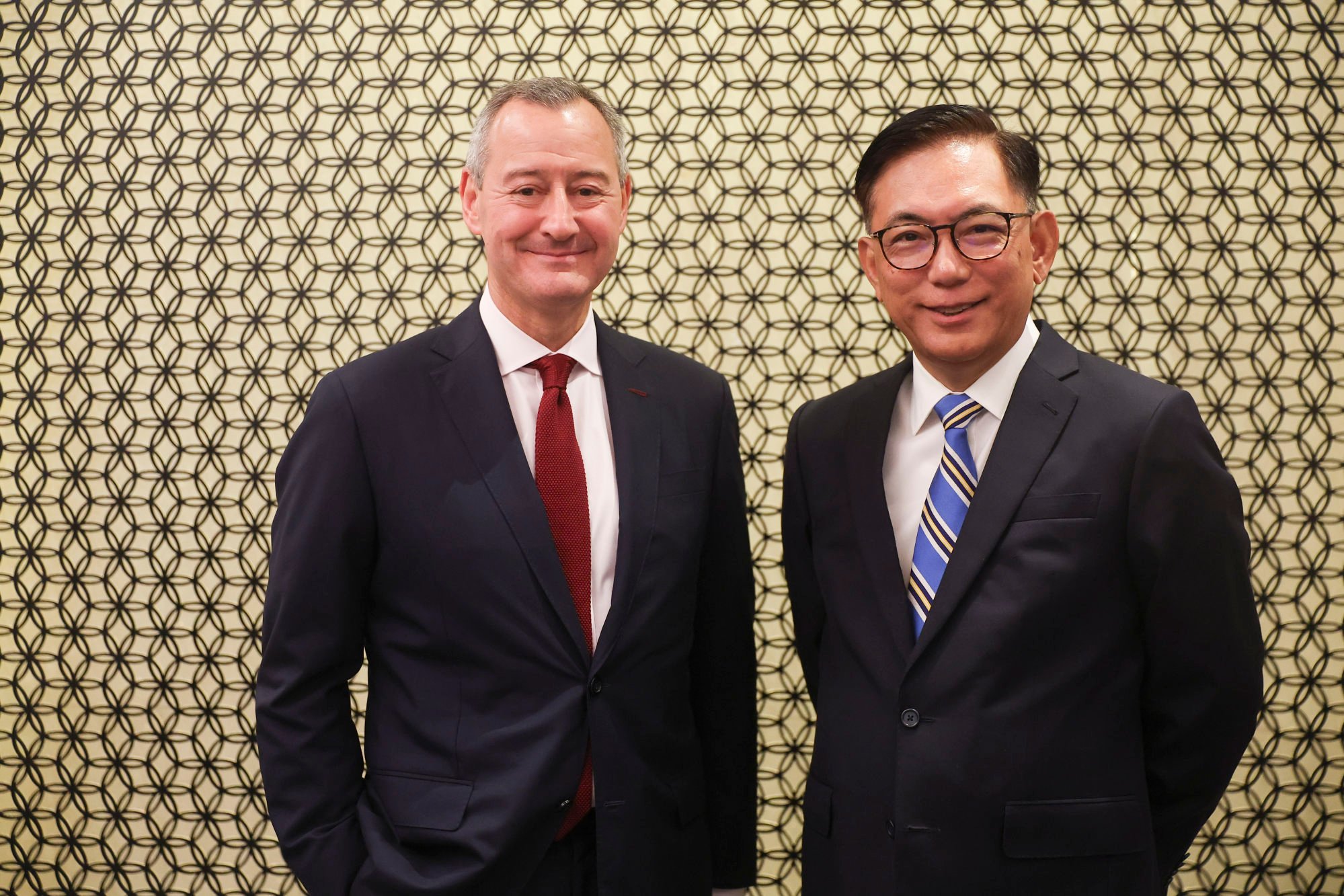

While Hong Kong continued to suffer a retail slump, assets in Singapore and Australia performed better than expected, the company said on Tuesday as it reported revenue and profit increases for the financial year ended in March. Link is not ruling out acquiring properties in challenged markets including Hong Kong, added George Hongchoy Kwok-lung, executive director and group CEO.

Tolong support kita ya,

Cukup klik ini aja: https://indonesiacrowd.com/support-bonus/

“There will be ongoing pressure” in the year ahead for rent reductions, but “one of the things that we’re very focused on is preserving occupancy”, he said. The company’s rental rate reversion – the industry term for when tenants negotiate lower rents upon renewal – was negative 2.2 per cent in Hong Kong during the financial year. Retail assets in Singapore had a positive reversion of 17.8 per cent.

Do you have questions about the biggest topics and trends from around the world? Get the answers with

SCMP Knowledge

, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Link’s earnings rose 4.6 per cent to HK$7.02 billion (US$896 million) for the year, while revenue increased 4.8 per cent to HK$14.22 billion. Net property income jumped 5.5 per cent to HK$10.6 billion.

Its total portfolio was worth HK$226 billion as of March 31, with more than 150 properties in Hong Kong, mainland China, Australia, Singapore and the UK. Three quarters of its assets were in Hong Kong, spanning retail properties, car parks and offices.

Link owns 12 properties in mainland China, accounting for about 14 per cent of its portfolio, with assets in retail, office and logistics, while overseas, it also owns 12 properties in the retail and office segments.

Occupancy in Link’s retail assets in Hong Kong was 97.8 per cent as of March 31, with more than 600 new leases signed during the year, it said. Average monthly rent stood at HK$63.30 per square foot as of the end of March, a 1.7 per cent decrease from a year earlier. Its portfolio in Hong Kong includes malls such as Stanley Plaza in the Southern district and Temple Mall in Wong Tai Sin, as well as prime office building Quayside in Kwun Tong.

Its mainland China retail portfolio, meanwhile, had a 95.9 per cent occupancy and recorded negative reversion of 0.7 per cent due to “underperformance” at Link Plaza Zhongguancun in Beijing. Excluding that, its mainland Chinese retail assets had positive reversion of 7.6 per cent, Link said.

In mainland China, the group owns Link Plaza Qibao in Shanghai, Link Plaza Liwan in Guangzhou and Link CentralWalk in Shenzhen, among others. It also has office and logistics assets.

“We’ve been able to maintain our occupancy in both Hong Kong and in mainland China over the period, and that’s certainly our focus for the year ahead,” Hongchoy said. “If that comes at the expense of some negative reversion in the short term, we’re prepared for that. In summary, I think that reversion will still see some pressure, but occupancy will be preserved.”

Link’s assets in

Australia

, which include The Galeries in Sydney, and in Singapore, such as retail property Jurong Point, had occupancy of at least 99 per cent.

The company said there could be good acquisition opportunities in Hong Kong given the number of distressed assets on the market.

“Hong Kong and mainland China assets, at a certain price, will be attractive to us,” Hongchoy said. “Banks have just started to accept some haircuts to allow the foreclosure on certain assets, so I think 2025 is a year of real reckoning, especially in Hong Kong.”

However, the company would be “extremely cautious” about investing in Hong Kong, he said.

With the group celebrating the 20th anniversary of its initial public offering in November, it is also looking for opportunities in other markets including Japan, the executives said.

“Sitting alongside the growth of the investment-management business is the improvement of the quality of our earnings, so we’re not vulnerable to any single geography or any single expertise,” said Duncan Owen, Link chairman. “We need to have a spread, which will improve the quality of the earnings through time.”

CGS International Securities kept its buy rating for Link Reit, saying that it was the brokerage firm’s “high conviction top pick” due to its high yield of about 7 per cent and “potential inclusion in the Hong Kong Stock Connect, which could attract a lot of mainland funds that look for high-dividend stocks”.

Retail sales in Hong Kong fell 3.5 per cent in March, marking the 13th straight month of decline, according to the latest official data. The drop was less severe than the 13 per cent plunge recorded in February. The slump has been attributed to lower tourist spending in the city and Hongkongers’ preference for shopping and dining in Shenzhen and elsewhere on the mainland, where prices are generally lower.

Between 2019 and 2023, rents in the city’s four core shopping locations – Causeway Bay, Central, Mong Kok and Tsim Sha Tsui – fell between 29 per cent and 47 per cent, according to Cushman & Wakefield. Last year, they improved by between 3.2 per cent and 6.7 per cent.

This year, around 700,000 sq ft of new prime retail property supply will be added to the existing stock, following an increase of 1.2 million sq ft in 2024, according to JLL.

More Articles from SCMP

Passenger arrested in Hong Kong for alleged theft on flight from Indonesia

Harvard Chinese student’s graduation speech strikes a chord as Trump leads crackdown

As Malaysia’s Huawei chip storm shows, sovereign AI is a fraught pursuit

Top football clubs need to repay Asian fans with value for money

This article originally appeared on the South China Morning Post (www.scmp.com), the leading news media reporting on China and Asia.

Copyright (c) 2025. South China Morning Post Publishers Ltd. All rights reserved.