Understanding the Role of Social Security in Retirement Planning

Transitioning from a regular paycheck to retirement can be a daunting experience for many Americans. The financial implications of this shift often take center stage, as Social Security payments alone are typically insufficient to cover daily expenses. To maintain financial stability, retirees often rely on personal savings and investment accounts such as 401(k)s and Individual Retirement Accounts (IRAs) to supplement their income.

The Challenges Facing Social Security

Social Security was never designed to be the sole financial support for retirees. However, its long-term sustainability has become a growing concern. According to a fact sheet from the Social Security Administration, there were approximately 2.7 active workers funding the system for every individual receiving benefits in 2023. This ratio is projected to decrease to 2.4 by 2035 due to the aging baby boomer population.

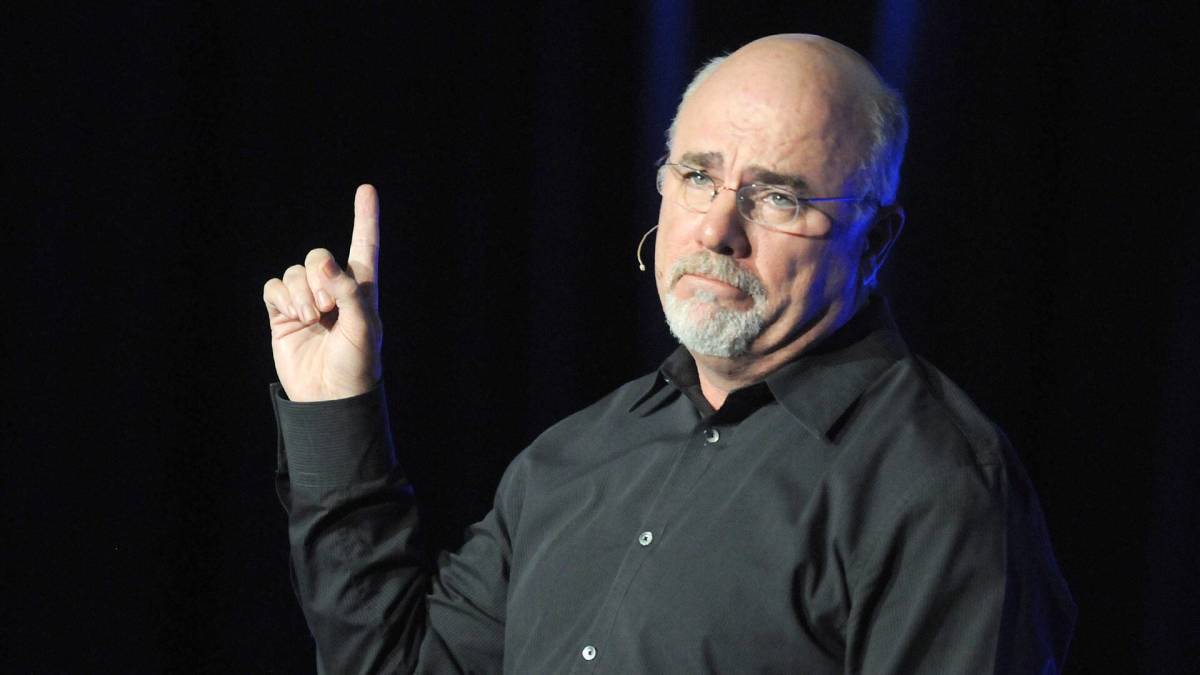

Financial expert Dave Ramsey warns that without legislative action, future beneficiaries may see their monthly payments drop to about 77% of current levels. He emphasizes that the trust funds supporting Social Security are expected to remain solvent only through 2034. This highlights the importance of diversifying retirement income sources beyond Social Security.

Key Considerations for Retirees

To qualify for Social Security benefits, individuals must accumulate at least 40 credits, which are earned based on income. In 2024, one credit was earned for every $1,730 of income, with a maximum of four credits per year. Earning $6,920 in a year ensures the full four credits needed to qualify for benefits.

Most workers reach the 40-credit threshold after about ten years of consistent employment. For those just starting out, Ramsey encourages early planning and consistent contributions to retirement accounts. Starting early allows individuals to build a more secure financial foundation for their later years.

The Importance of Personal Investment Accounts

Ramsey advocates for prioritizing personal investment accounts over relying solely on Social Security. He suggests that 401(k)s and IRAs should serve as the primary source of retirement income. These accounts offer tax advantages and provide flexibility in managing retirement funds.

Individuals can begin collecting Social Security benefits as early as age 62, even if they continue working. However, claiming benefits before reaching full retirement age results in reduced payments. For those born in 1960 or later, the full retirement age is 67. Understanding how timing affects benefit amounts is crucial for making informed decisions about when to retire.

Making the Most of Social Security Benefits

One of the biggest challenges for new Social Security recipients is deciding when to start collecting benefits. Individuals often face the dilemma of taking a reduced payment early or waiting for a larger amount later. Ramsey notes that this decision is usually irreversible once benefits begin.

He advises that for many, it may be wiser to start receiving payments sooner rather than later. His reasoning is straightforward: “Retirement payments die when you die,” he wrote. “You might as well take the money and make the most of it while you can.”

Conclusion

Retirement planning requires a comprehensive approach that includes understanding the role of Social Security and leveraging personal investment accounts. While Social Security provides a vital safety net, it should not be the sole focus of retirement strategy. By starting early, contributing consistently, and making informed decisions about when to claim benefits, individuals can better secure their financial future.