Understanding the Zacks Rating System and Its Impact on Stock Performance

The Zacks rating system is a powerful tool for investors looking to make informed decisions about their stock portfolios. It focuses on a company’s changing earnings picture, which is one of the most significant factors influencing stock prices. This approach provides an objective measure that can help investors navigate the often subjective nature of Wall Street analyst ratings.

The Role of Earnings Estimates in Stock Valuation

Earnings estimates play a crucial role in determining the fair value of a company’s shares. Institutional investors, in particular, rely heavily on these estimates when assessing whether a stock is undervalued or overvalued. When analysts revise their earnings estimates upward, it often signals a positive outlook for the company, leading to increased demand for its shares and, subsequently, higher stock prices.

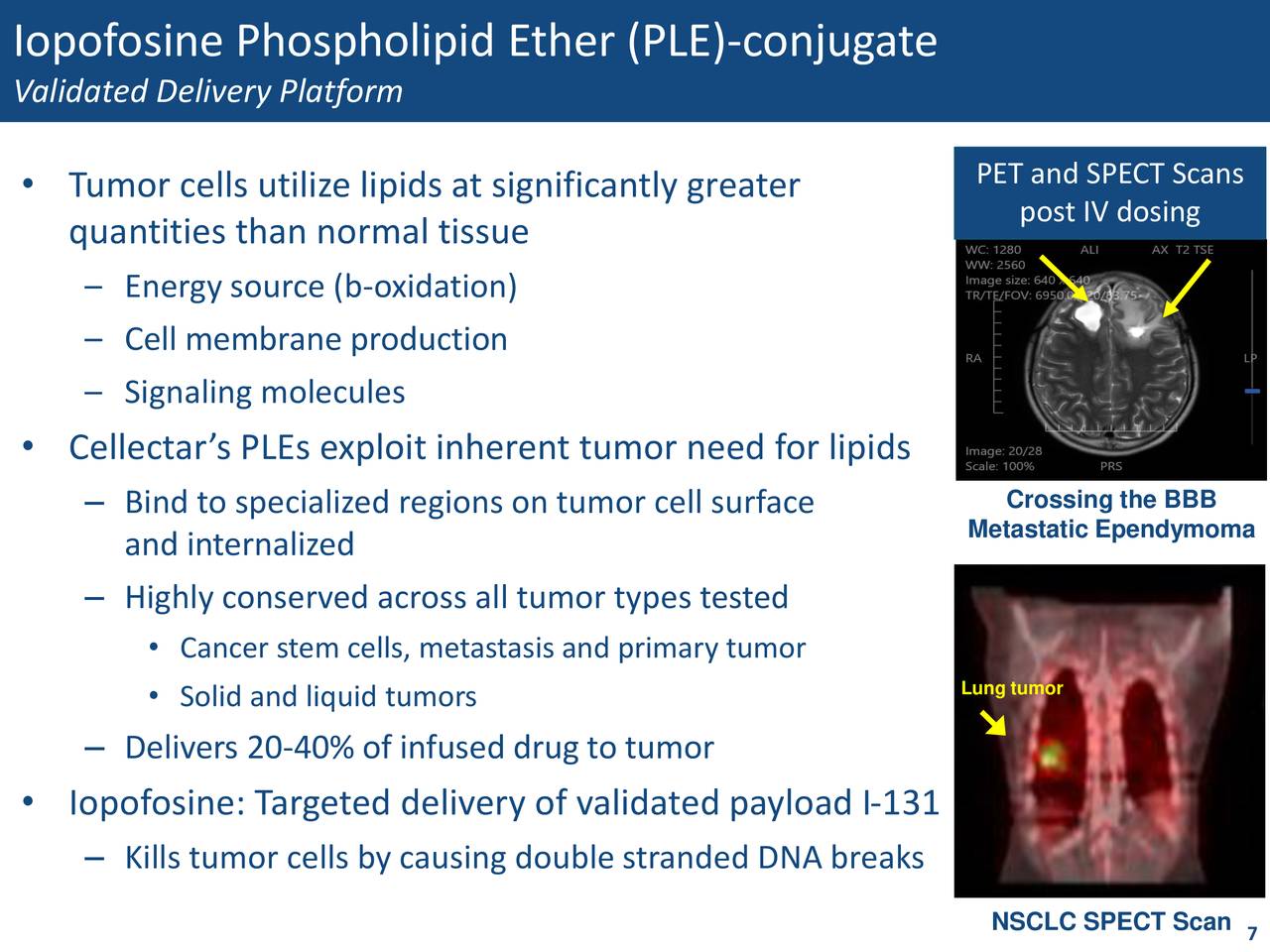

For Cellectar Biosciences, Inc. (CLRB), the recent upgrade to a Zacks Rank #2 (Buy) reflects an upward trend in earnings estimates. This change is not just a simple rating adjustment; it indicates a more favorable earnings outlook for the company. As a result, investors may find this stock appealing, especially if they are looking for opportunities in the biotechnology sector.

Correlation Between Earnings Revisions and Stock Price Movements

Empirical research has shown a strong correlation between trends in earnings estimate revisions and near-term stock price movements. This relationship is largely driven by institutional investors who use these estimates to guide their investment decisions. When earnings estimates improve, the perceived fair value of a stock increases, prompting investors to buy more shares, which can lead to a rise in the stock price.

This dynamic is particularly relevant for companies like Cellectar Biosciences, where the improvement in earnings estimates suggests an underlying strengthening of the business. Investors who recognize this trend may choose to support the stock, further contributing to its potential for growth.

The Zacks Rank System: A Reliable Investment Tool

The Zacks Rank system is designed to harness the power of earnings estimate revisions by classifying stocks into five categories based on four factors related to earnings estimates. These categories range from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell).

Historically, Zacks Rank #1 stocks have demonstrated impressive returns, with an average annual return of +25% since 1988. This track record makes the Zacks Rank system a valuable resource for investors seeking to identify stocks with strong potential for outperformance.

Earnings Estimate Revisions for Cellectar Biosciences

Looking at the specific case of Cellectar Biosciences, the company is expected to earn -$14.87 per share for the fiscal year ending December 2025. While this figure remains unchanged compared to the previous year, analysts have been steadily raising their estimates for the company. Over the past three months, the Zacks Consensus Estimate for Cellectar Biosciences has increased by 26.1%, indicating a positive shift in the market’s perception of the company.

The Significance of the Zacks Rank #2 Upgrade

The upgrade of Cellectar Biosciences to a Zacks Rank #2 places it in the top 20% of Zacks-covered stocks in terms of estimate revisions. This position suggests that the stock has a strong potential to move higher in the near term. Unlike other rating systems that tend to be overly optimistic, the Zacks system maintains a balanced approach, ensuring that only the top 5% of stocks receive a “Strong Buy” rating and the next 15% receive a “Buy” rating.

For investors, this means that a Zacks Rank #2 rating is a strong indicator of a company’s potential for generating market-beating returns. By focusing on earnings estimate revisions, the Zacks system helps investors identify stocks that are likely to perform well, even in challenging market conditions.

In summary, the Zacks rating system offers a reliable and objective way to evaluate stocks based on their earnings potential. For Cellectar Biosciences, the recent upgrade to a Zacks Rank #2 highlights a positive outlook for the company, making it a compelling investment opportunity for those looking to capitalize on improving earnings estimates.