-

Innovators could face being the biggest losers with this super tax.

A software tycoon boasts an astounding $1.7 billion in their retirement account, positioning them squarely as one who will bear the brunt of Labor’s proposed additional tax on superannuation funds.

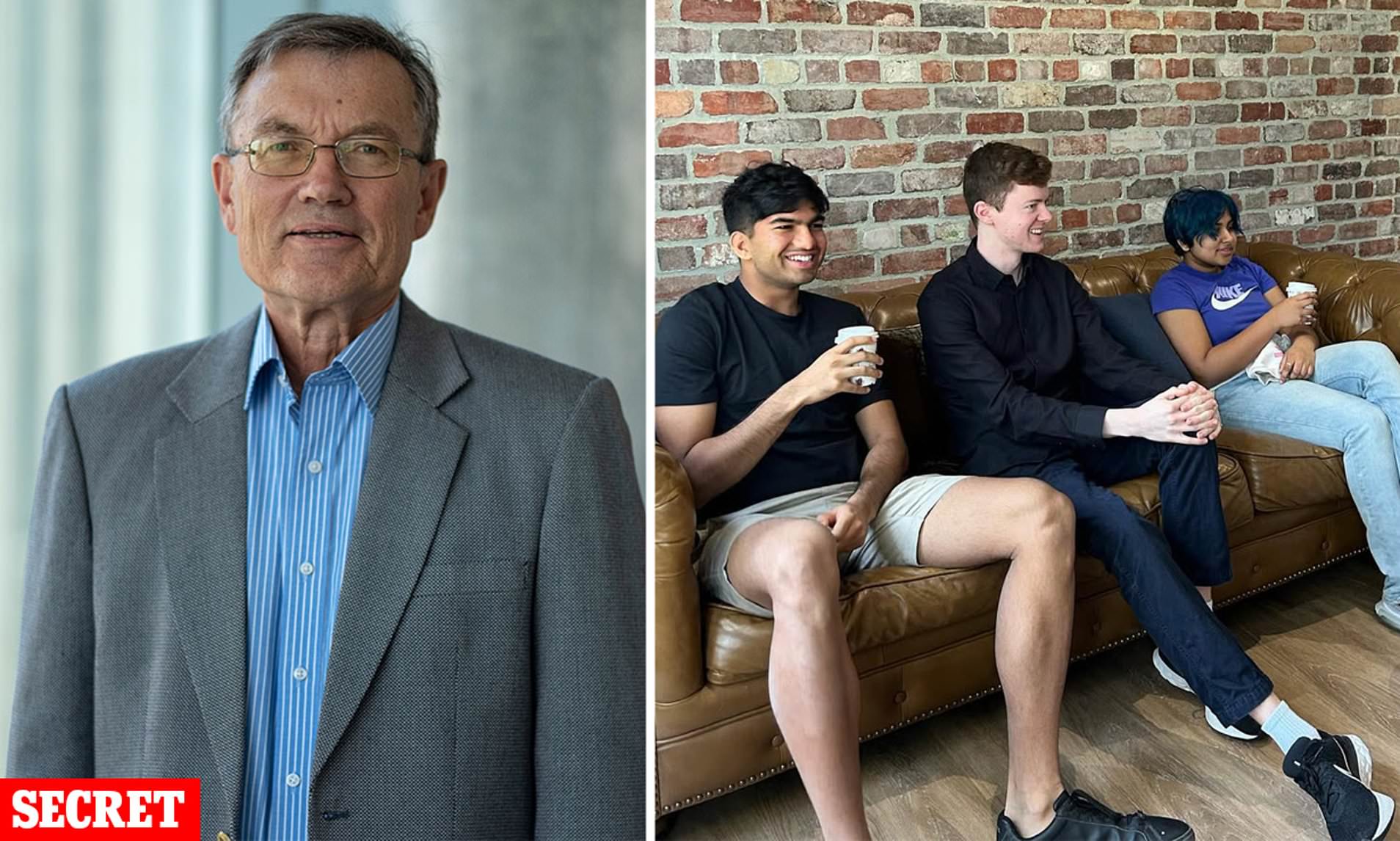

Charles Gibbon, aged 76, who serves as a director at the software company WiseTech, might just be among Australia’s most dedicated participants in self-managed superannuation funds.

His family’s Fabemu No. 2 self-managed superannuation fund holds 15,594,630 shares in WiseTech, which could face significant financial impact should Labor’s proposed tax reforms become legislation on July 1st.

Tolong support kita ya,

Cukup klik ini aja: https://indonesiacrowd.com/support-bonus/

Should his shares climb by 10 percent over the upcoming fiscal year, pushing their price up to $119.65, the total worth of the superfund would jump from $1.696 billion to $1.866 billion.

The labor proposal includes introducing a new 15% tax on unrealized gains within superannuation accounts where the balance exceeds $3 million. This tax would be levied based solely on hypothetical profits rather than actual earnings.

The $169.67 million rise in value within Mr. Gibbons’ superfund would result in a tax liability of $25.4 million based solely on these theoretical gains… without him actually offloading any shares.

The elusive businessman, who hails from

New Zealand

‘S South Island has been serving as a WiseTech board member since 2006.

He amassed his staggering $2 billion fortune by investing early in WiseTech, which was established in 1994.

In the initial stages of the internet, the company began developing software for the freight sector. Currently, it ranks as the 21st largest entity on the Australian Securities Exchange and stands out globally as a pioneer in this field.

supply chain

software.

Mr. Gibbon played a crucial role in the success of the $36 billion company and remained supportive of embattled WiseTech founder Richard White when other board members resigned in February, after a series of disclosures and claims regarding White’s personal life.

He divides his time between Sydney’s eastern suburbs, where he resides in a grand Woollahra home alongside his spouse Claire, and the NSW South Coast, possessing a six-hectare retreat near Berry called Bellawongarah, as well as coastal property in Gerringong.

He was raised in Invercargill prior to pursuing a Bachelor of Science with an emphasis on pure mathematics at the University of Otago. Later, he worked as a London-based stock analyst.

Even though he is affluent, he avoids public attention and seldom shows up at Australia’s lavish social events attended by the elite rich.

In 2022, Mr Gibbon was included among the esteemed billionaires on The Australian Financial Review’s exclusive Rich List following a significant increase in his company’s stock price, which rose from $11.80 in March 2020 to $55.95.

By Thursday, WiseTech’s stock price had risen to $108.77, nearly doubling over the past three years, even though there were some setbacks earlier in the year due to internal conflicts within the company’s leadership.

The share price has propelled his superannuation fund portfolio past the billion-dollar threshold – putting him squarely in the sights of Labor’s new superannuation tax targeting the wealthy.

However, experts caution that the tax might lead to unforeseen outcomes and penalize emerging startup firms before they get an opportunity to thrive as WiseTech has.

Ben Johnston, an accounting specialist in tax planning and a director at Johnston Advisory, anticipates that technology startups could suffer financially if this new legislation takes effect on July 1st.

Affluent self-managed superannuation funds might have to liquidate their holdings to evade the new taxation on hypothetical uncrystallized profits, which could impede the expansion of emerging companies.

“They depend on significant financial supporters to keep their investments intact throughout the initial stages of the startup,” he explained to Daily Mail Australia.

If they decide to liquidate these assets to increase liquidity within their Self-Managed Super Fund (SMSF), this could pose a problem for startups.

Data from the tax authorities indicated that among start-ups possessing over $50 million in assets, 23.2% allocated funds to stocks listed on the Australian Securities Exchange, whereas only 7.5% put their money into unlisted entities, potentially including young companies not yet traded publicly.

At the end of June last year, Australia had 616,941 self-managed superannuation funds.

They had 1.142 million members, with multiple individuals permitted to hold membership.

The Greens aim to lower the threshold to $2 million but have it adjusted for inflation.

The proposal from Labor includes a $3 million limit that will not be adjusted for inflation.

The overall earnings tax would increase twofold to 30 percent over this limit, encompassing the additional 15 percent levy on unrealized gains, all calculated according to changes in the total superannuation balance.

The overall tax levy encompasses a 15 percent charge on earnings accumulated throughout a fiscal year. This includes revenue generated from investments in a self-managed superannuation fund, such as renting out a property, profits from selling assets, or increases in asset values.

Earnings

Would only face taxation during the accumulation stage rather than the retirement phase of super once an individual becomes eligible to access their superannuation at age 60.

The federal government, which has been re-elected, now requires support from the Greens to pass its legislation through the Senate.

However, before that happened, Mr Johnston stated that it was challenging to provide guidance to his clients on whether they needed to offload their profitable investments to dodge Labor’s suggested new taxation measures.

“I’m primarily advising them to assess their liquidity since much of it involves speculation,” he stated.

The issue here lies in the uncertainty – it’s challenging to adequately address it since the taxes apply to the yet-to-be-realized gains.

If you plan to undertake significant actions without being certain of the benefits you might achieve; once more, you’re presupposing that you will reap gains from the outset.

‘And to decide to sell off real estate or stocks in possibly lucrative businesses solely because of a future tax issue, that’s quite a bold move and may not be the best course of action.’

The issue would become even more evident in self-managed superannuation funds with a greater share of their assets tied up in properties such as farmlands, which may have been profitable yet challenging to liquidate for covering taxes due.

“If your self-managed superannuation fund has $10 million invested primarily in areas like real estate, agricultural properties, or various types of land, and at the same time you have minimal liquidity, you’re facing a significant issue,” Mr Johnston stated.

Once newly elected senators assume office in July, Labor might be able to advance the Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill through Parliament in 2023 following this date. They would gain necessary backing from 11 Green Party senators and seek to make the legislation retroactive to start from July 1st.

The Labor Party would no longer require backing from centrist and leftist independent senators such as Jacqui Lambie or David Pocock, who have voiced reservations about levying taxes on unmaterialized profits.

In early December, Fabemu offloaded 1.5 million shares for a total of $200 million.

Read more