- Trump tariffs return, yet ASX edges up

- HealthCo rises due to Healthscope lease agreement

- Paladin faces another lawsuit, Viva experiences a dip, NRW secures the Rio position.

The Australian Securities Exchange (ASX) began Friday with fluctuating sentiment, as the ASX 200 index seesawed between positive and negative territory before climbing slightly by 0.1% around 1 pm, AEST.

Investors went to sleep last night optimistic that Trump’s worldwide tariff initiative was finally put to rest, only to discover upon waking that it remained very active.

Yesterday, the markets celebrated a U.S. trade court ruling that overturned a significant portion of President Trump’s tariff plans.

The court ruled that the president had overstepped his authority under the International Emergency Economic Powers Act (IEEPA) by slapping tariffs on dozens of nations.

The judges emphasized: the issue wasn’t about assessing whether the tariffs were sensible or not; the legislation simply did not support his stance.

However, before markets could fully celebrate their win, a higher court intervened, slamming the brakes on the jubilation. The US Court of Appeals issued a temporary stay, indicating that Trump’s tariffs remain active, at least for the time being.

Trump’s trade adviser Peter Navarro declared the tariffs are “alive, well, healthy,” while White House press secretary Karoline Leavitt warned the Supreme Court may need to step in to protect presidential powers.

Even with the turmoil and a series of negative indicators from the US economy – including data revealing a 0.2% contraction in US GDP for the first quarter – Wall Street managed to finish in positive territory overnight.

However, bond yields dropped as traders began anticipating potential Federal Reserve interest rate reductions.

In an off-the-record discussion at the White House, Trump had a meeting with Federal Reserve Chair Jerome Powell, during which he allegedly pressed for lower interest rates. According to reports, Powell supposedly informed the President that such choices would be based on economic data rather than social media posts.

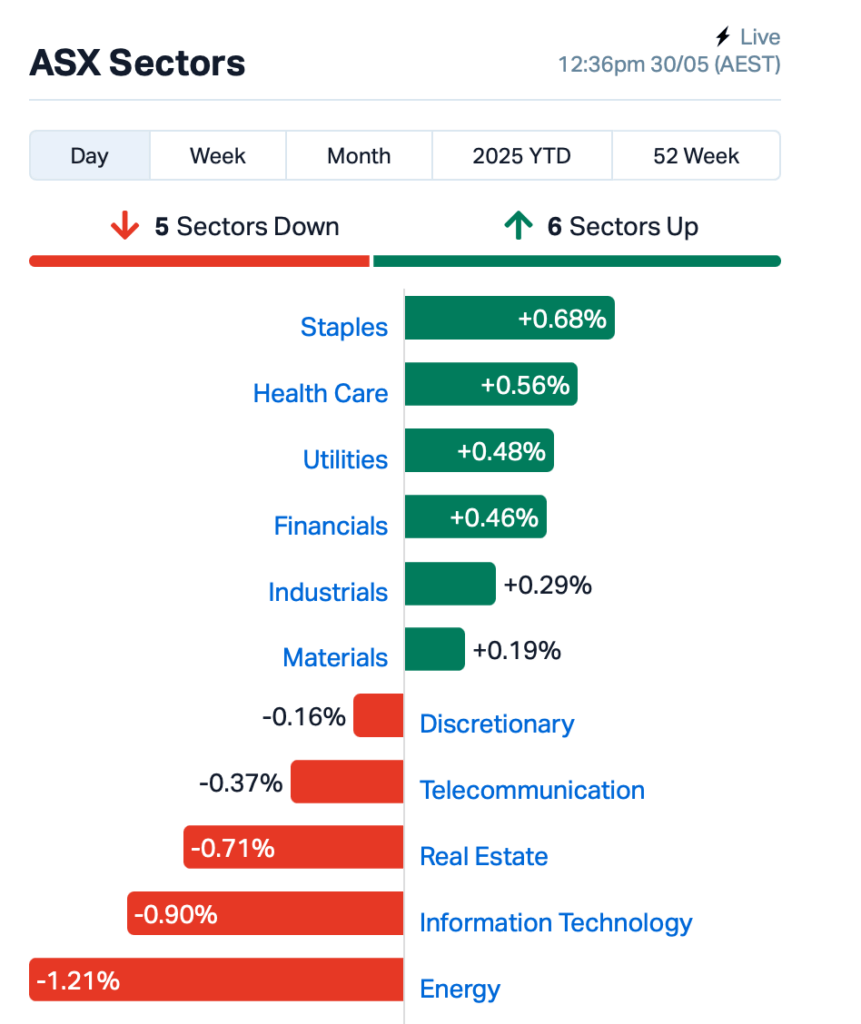

For the Australian Securities Exchange (ASX), out of 11 sectors, 5 appeared to be declining today. The energy sector was at the forefront of decliners with falling oil prices impacting stock values.

Gold mining shares surged as precious metals gained appeal, spurred by uncertainties related to tariffs and updated figures on unemployment from the United States.

In large caps news,

Paladin Energy (ASX:PDN)

has come under criticism once more, as a second lawsuit is being prepared due to its handling of production estimates at the Langer Heinrich uranium mine located in Namibia.

The Banton Group is preparing to submit once again. The initial class action was initiated by Slater and Gordon on April 16, based on comparable allegations.

Viva Energy (ASX:VEA)

received the go-ahead from Victoria to proceed with its Geelong LNG terminal. However, even though approval was granted, Viva’s share price dropped by 2%.

And still in large caps, mining services firm

NRW Holdings (ASX:NWH)

rose 1% following a $157 million contract awarded to its subsidiary Primero for constructing infrastructure.

Rio Tinto (ASX:RIO)

‘S Hope Downs mine in the Pilbara.

ASX SMALL CAP WINNERS

Below are the top-performing ASX small-cap stocks as of May 30 [during trading sessions]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.004 | 100% | 9,000 | $778,353 |

| ERL | Empire Resources | 0.005 | 67% | 319,668 | $4,451,740 |

| CR9 | Corellares | 0.003 | 50% | 412,320 | $2,011,213 |

| ASP | Aspermont Limited | 0.007 | 40% | 1,209,102 | $12,365,938 |

| TAS | Tasman Resources Ltd | 0.025 | 39% | 455,510 | $3,314,567 |

| CZN | Corazon Ltd | 0.002 | 33% | 700,000 | $1,776,858 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 296,327 | $8,429,639 |

| SHP | South Harz Potash | 0.004 | 33% | 404,999 | $3,308,186 |

| LOC | Locatetechnologies | 0.090 | 29% | 352,514 | $14,083,568 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 198,136 | $6,296,765 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 599,251 | $3,479,814 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 159,004 | $8,013,537 |

| OVT | Ovanti Limited | 0.003 | 25% | 507,500 | $5,587,030 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 1,000,000 | $6,350,111 |

| RGL | Riversgold | 0.005 | 25% | 189,093 | $6,734,850 |

| TEM | Tempest Minerals | 0.005 | 25% | 421,040 | $2,938,119 |

| VML | Vital Metals Limited | 0.003 | 25% | 494,000 | $11,790,134 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 1,155,003 | $18,739,112 |

| WBE | Whitebark Energy | 0.005 | 25% | 100,000 | $2,749,334 |

| NHE | Nobleheliumlimited | 0.011 | 22% | 557,421 | $5,395,725 |

| OLL | Openlearning | 0.018 | 20% | 145,461 | $7,240,120 |

| AZL | Arizona Lithium Ltd | 0.006 | 20% | 3,857,357 | $26,351,572 |

| PIL | Peppermint Inv Ltd | 0.003 | 20% | 200,000 | $5,690,224 |

| LKY | Locksleyresources | 0.079 | 20% | 28,480,896 | $9,680,000 |

| CC5 | Clever Culture | 0.019 | 19% | 5,784,516 | $28,252,645 |

WordPress Table

Mining media company

Aspermont (ASX:ASP)

Has recorded its 35th consecutive quarter ofsubscription growth, with subscriptions accounting for 75% of total income. The recurring subscription revenue reached $11.2 million, marking a 4% increase from last year, whereas the overall group revenue fell by 6%, totaling $6.7 million. Although the EBITDA remains in negatives, the firm maintains zero debt and holds onto $700K in cash reserves.

Tempest Minerals (ASX:TEM)

Has enhanced the sampling process at its Sanity gold deposit within WA’s Yalgoo project, with the outcomes showing promise. By boosting the sample frequency, they have refined the delineation of a robust and unbroken gold anomaly, suggesting the possibility of an extensive mineralized system. TEM mentions that the Sanity site is located in a highly prospective area, supported by rock chip samples yielding grades as high as 7g/t gold.

Healthco Healthcare and Wellness REIT (ASX:HCW)

rose following a critical support agreement with the financially strained hospital management firm Healthscope and its receivers, where they decided to postpone rental fees for multiple locations. This arrangement aided in calming concerns over HealthCo’s revenue sources and provided some much-needed transparency during this chaotic period. The investors were evidently pleased with the stabilized financial inflow and quickly increased their investments.

ASX SMALL CAP LOSERS

Below are the lowest-performing ASX small-cap stocks as of May 30 [during trading sessions]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BLZ | Blaze Minerals Ltd | 0.002 | -33% | 142,857 | $4,700,843 |

| AOA | Ausmon Resorces | 0.002 | -25% | 357,633 | $2,622,427 |

| BMO | Bastion Minerals | 0.002 | -25% | 500,000 | $1,807,255 |

| RAN | Range International | 0.002 | -25% | 3,198,946 | $1,878,581 |

| MGA | Metalsgrovemining | 0.061 | -25% | 50,000 | $8,539,020 |

| WNX | Wellnex Life Ltd | 0.300 | -22% | 47,583 | $26,092,038 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1,597,010 | $15,867,318 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 519,000 | $9,929,183 |

| PLC | Premier1 Lithium Ltd | 0.009 | -18% | 1,932,215 | $4,048,666 |

| REZ | Resource & Eng Group Ltd | 0.015 | -17% | 492,052 | $12,089,504 |

| DAF | Discovery Alaska Ltd | 0.010 | -17% | 25,000 | $2,810,816 |

| KPO | Kalina Power Limited | 0.005 | -17% | 2,468,473 | $17,597,818 |

| OEL | Otto Energy Limited | 0.005 | -17% | 888,386 | $28,770,059 |

| TEG | Triangle Energy Ltd | 0.003 | -17% | 500,999 | $6,267,702 |

| CML | Connected Minerals | 0.130 | -16% | 10,139 | $6,410,523 |

| ADG | Adelong Gold Limited | 0.006 | -14% | 59,334,827 | $9,782,403 |

| OM1 | Omnia Metals Group | 0.012 | -14% | 820,682 | $3,039,284 |

| QXR | Qx Resources Limited | 0.003 | -14% | 700,000 | $4,586,151 |

| SRJ | SRJ Technologies | 0.013 | -13% | 15,005 | $9,083,671 |

| 1CG | One Click Group Ltd | 0.007 | -13% | 398,955 | $9,423,039 |

| AX8 | Accelerate Resources | 0.007 | -13% | 235,331 | $6,377,510 |

| HFY | Hubify Ltd | 0.007 | -13% | 43,849 | $4,089,090 |

| CRD | Conradasiaenergyltd | 0.620 | -12% | 158,139 | $132,939,151 |

| DBO | Diabloresources | 0.015 | -12% | 58,660 | $2,296,970 |

WordPress Table

IF YOU SAW IT YET

Tylah Tully from ‘s looks at

White Cliff Minerals’ (ASX:WCN)

exploration at Danvers, which continues non-stop,

High-quality copper and silver deposits near the surface have been verified.

.

Tylah also analyses the most recent updates from

West Coast Silver (ASX:WCE)

,which has

began drilling to assess expansions of recognized high-quality mineralization

At its Elizabeth Hill project located in Western Australia.

Here, we call it as we see it. Even though White Cliff Minerals and West Coast Silver are sponsors of our content, they didn’t influence this particular piece.

This piece of writing doesn’t serve as financial product advice. It would be wise to seek independent advice prior to making any financial choices.

The post

Lunch Wrap: ASX walks tightrope; lawsuit number two looms for Paladin

appeared first on

.